Nvidia's $5 Trillion AI Empire: Can Competitors Catch Up?

The $5 Trillion Milestone: Nvidia's Unprecedented Rise

In October 2025, Nvidia made history by becoming the world's first $5 trillion company, surpassing tech giants like Microsoft and Apple. This extraordinary achievement underscores the company's dominant position in the artificial intelligence hardware market, fueled by explosive demand for its AI chips since the generative AI boom began in 2022.

The journey to this milestone has been breathtaking. Just three months after reaching $4 trillion in July 2025, Nvidia surged past $5 trillion. To put this in perspective, the company was valued at approximately $400 billion before OpenAI's ChatGPT debuted in late 2022. In 2025 alone, Nvidia's stock has risen over 50%, adding more than $400 billion in market capitalization across just two trading days.

AI Chip Dominance: $500 Billion in Orders

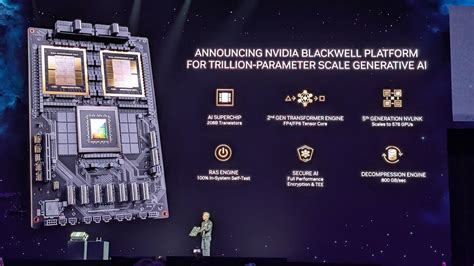

At Nvidia's GTC developer conference, CEO Jensen Huang announced a staggering $500 billion in orders for AI chips through the end of 2026. This unprecedented revenue visibility comes from both current Blackwell-generation chips and upcoming Rubin processors launching in 2026. Huang emphasized: "I think we are probably the first technology company in history to have visibility into half a trillion dollars [in revenue]."

The company has already shipped 6 million Blackwell chips over the past four quarters and expects to deliver an additional 14 million units in the next five quarters. This demand stems from major cloud providers like Amazon, Meta, Google, and Microsoft, whose projected capital expenditures for AI infrastructure will reach $632 billion by 2027.

The Competition: Can Intel and AMD Challenge Nvidia?

Despite Nvidia's commanding position—controlling an estimated 90% market share of AI chips—competitors like Intel and AMD are not backing down. The Bloomberg article highlights whether these rivals can close the performance gap. Nvidia's Blackwell architecture, described by President Trump as "super-duper" and "probably 10 years ahead of any other chip," has set a formidable benchmark. Intel's investments in new chip technologies and AMD's focus on competitive GPU solutions remain critical to watch, though industry analysts suggest significant hurdles remain.

"The AI gold rush is still accelerating," notes industry analyst Ian King, pointing to multi-billion-dollar data center investments continuing to pour into Nvidia's ecosystem.

The China Conundrum: Market Access and Geopolitics

A significant challenge for Nvidia is its lost access to the Chinese market. Export controls and Chinese restrictions have decimated Nvidia's market share there, dropping from 95% to nearly zero. This shift cost the company billions, with Chinese revenue plummeting from $15.5 billion to just $2.8 billion in the most recent quarter.

However, there are signs of potential thawing. President Trump indicated plans to discuss Nvidia's Blackwell chips with Chinese President Xi Jinping, signaling a possible re-engagement. The outcome of these talks could dramatically impact Nvidia's future growth trajectory and global market dynamics.

Manufacturing and Partnerships: Building the Future

In response to shifting trade policies, Nvidia has ramped up U.S. manufacturing, now producing Blackwell GPUs in full at an Arizona facility—attributed to Trump's push for domestic production. The company has also forged strategic partnerships:

- A $1 billion investment with Nokia to develop 5G/6G telecommunications equipment

- A collaboration with Oracle to build seven supercomputers for the U.S. Department of Energy, featuring up to 100,000 Blackwell AI chips

The Road Ahead: Rubin and Beyond

Looking forward, Nvidia's Rubin generation chips promise to extend its technological lead. With the AI market showing no signs of slowing—hyperscaler capital expenditures projected to grow 24% in 2026—all eyes are on whether competitors can innovate quickly enough to challenge Nvidia's dominance. As Huang envisions a future workforce blending humans and "digital humans," Nvidia's influence extends far beyond hardware into the very fabric of AI-driven society.

Share this article

Sarah Johnson

Technology journalist with over 10 years of experience covering AI, quantum computing, and emerging tech. Former editor at TechCrunch.