Defense Strategies for Volatile Tech Stocks

Navigating Market Volatility: How to Protect Your Portfolio

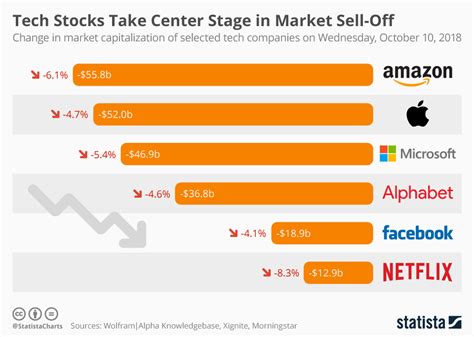

Recent market turbulence has tech investors on edge as rising interest rates and economic uncertainty trigger widespread sell-offs in growth stocks. If your portfolio is heavily weighted toward technology companies, now's the time to implement defensive strategies that can shield your investments during market downturns.

Why Tech Stocks Are Under Pressure

Technology stocks have historically been sensitive to interest rate changes. As central banks hike rates to combat inflation, the present value of future cash flows for growth-oriented tech companies diminishes. This dynamic, combined with concerns about slowing consumer spending and corporate earnings, has created perfect conditions for volatility in tech-heavy indices.

"The key isn't abandoning tech entirely, but rebalancing your approach to include assets that perform well during economic uncertainty."

Core Defensive Strategies

1. Shift to Defensive Sectors: Consider reallocating capital toward historically stable sectors like consumer staples, healthcare, and utilities. These industries provide essential goods and services that maintain demand even during economic contractions.

2. Dividend Aristocrats: Focus on companies with consistent dividend payment histories. Firms in the S&P 500 Dividend Aristocrats index have increased dividends for 25+ consecutive years, offering both income and relative stability.

3. Quality Over Growth: Prioritize companies with strong balance sheets, high profit margins, and durable competitive advantages over high-growth but unprofitable tech firms. Defensive stocks typically have lower price-to-earnings ratios.

Practical Portfolio Adjustments

Position Sizing: Limit your exposure to any single sector to no more than 20-25% of your portfolio. For tech-heavy portfolios, gradually reduce positions while building allocations to defensive sectors.

ETF Diversification: Consider adding sector-specific ETFs like Consumer Staples Select Sector (XLP) or Health Care Select Sector (XLV) to provide instant diversification with professional management.

Long-Term Perspective

While defensive strategies offer protection during downturns, remember that tech stocks drive innovation and long-term market growth. The most balanced approach combines defensive positioning with selective exposure to high-quality tech fundamentals. Rebalance your portfolio quarterly to maintain your desired risk profile regardless of market conditions.

Market volatility creates opportunities for disciplined investors. By implementing these defensive strategies, you can position your portfolio to weather current headwinds while remaining poised to capitalize on future market recoveries.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.