AI Stock Rout Drives Market Selloff

AI Stocks Lead Market Decline Amid Economic Jitters

U.S. markets experienced significant volatility on Thursday as artificial intelligence stocks faced renewed selling pressure, dragging major indices lower. The Nasdaq Composite plunged 1.9%, while the S&P 500 fell 1.2% and the Dow Jones Industrial Average slipped 455 points (1%) as investors grappled with valuation concerns in the tech sector and broader economic uncertainty.

AI Sector Takes Center Stage in Market Turmoil

The decline was particularly pronounced in AI-related stocks, despite some companies reporting strong earnings. Qualcomm dropped 4% even after exceeding quarterly expectations, while Advanced Micro Devices (AMD) plunged 7% following a brief recovery the previous day. Other notable decliners included Palantir Technologies (down 4%) and Oracle (3%).

p>However, Marvell Technology bucked the trend, gaining nearly 1% on reports that SoftBank had considered a potential takeover. This volatility highlights the market's sensitivity to AI sector performance, with Shirl Penney of Dynasty Financial Partners noting, "We're still very early in the AI super-cycle... There's going to be continued significant capex..."

Labor Market Concerns Amplify Selling Pressure

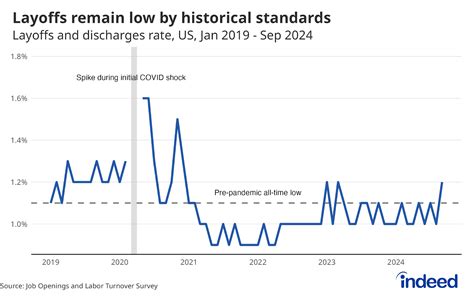

Market sentiment was further dampened by alarming labor market data. October saw 153,074 job cuts - a staggering 183% increase from September and 175% higher than the previous year. This represents the highest October layoff count in 22 years, with 2025 already becoming the worst year for layoffs since 2009. The figures paint a concerning picture of economic health, particularly as the government shutdown continues to limit economic data releases.

Government Shutdown and Trade Policy Add Uncertainty

The ongoing 37-day government shutdown - now the longest in U.S. history - continues to cloud economic outlooks. Investors are also closely watching Supreme Court arguments regarding the Trump administration's tariffs, with many expecting a ruling that could trigger a rollback of these trade taxes, potentially providing a boost to markets.

Individual Stock Highlights

Beyond sector-wide movements, several individual stocks made significant moves. Duolingo cratered 27% after providing lighter-than-expected guidance as it prioritizes long-term user growth over near-term profits. Celsius Holdings plummeted more than 23% after announcing that the integration of its Alani Nu brand would create "noisy" results in the fourth quarter. Meanwhile, Bumble tumbled 22% after missing earnings estimates, leading RBC Capital Markets to downgrade the stock.

What's Next for Investors?

While all three major indexes remain in the red for the week, some analysts see the AI sector's volatility as part of a normal growth cycle. The confluence of factors - from AI valuation concerns and labor market weakness to political uncertainty - creates a complex environment. Investors will be watching for resolution on government funding, Supreme Court rulings, and any signs of stabilization in the tech sector as the week progresses.

Share this article

Michael Chen

Business and finance reporter specializing in market analysis, startups, and economic trends. MBA from Harvard Business School.